A lot of people refer to an after-death plan as their “final wishes.” It is a legal document that tells your family what you would like done with your assets and estate when you die. It could also include details of the type of funeral home you’d want to be taken. The content, scope, and complexity of the document depend a lot on the size and breadth of your assets; it can range from not much more than a few lines to dozens of pages.

If you do not have any children or other immediate family members, then this may be easier as you can choose to give to a charity or friends. But for many, this is a difficult choice to make.

No one likes to think about their own mortality, but planning for the future is an important part of life. Creating an after-life plan can help ensure that your wishes are carried out and your loved ones are taken care of after you’re gone. Here are five steps to help you get started.

Why Have an After-life Plan?

We all know that death is inevitable, but the thought of it can be quite frightening. The prospect of not existing or being alive leaves people feeling depressed and anxious.

One way to handle this problem is to make an after-life plan. You will no longer be left in limbo about what you want and how you want it after passing on because you made the decisions beforehand. This also leaves friends, family, and loved ones at peace about the situation because they know that their loved one’s wishes will be carried out.

To make an after-life plan, there are several things that should be taken into account. These include legal documents to be signed before one makes a decision about life support systems or organ donation. It is also important to have a health care proxy who can make tough decisions in case you are incapacitated.

Making the Plan

For those who want to make a plan, it is important to realize that you can take steps to place your house in order before death. For example, you make a will early. A will is also called an “estate plan” and refers to how your assets and property are distributed after you die. It is a legal document that allows your loved ones to control your assets after you die.

You can also take steps to help determine where, when, and how you want the distribution of assets to take place after you die. One way this may be accomplished is through creating a trust.

There are two types of trusts: revocable and irrevocable. A revocable trust is one in which you can take action to change its terms. An irrevocable trust cannot be changed once it has been created.

A revocable trust is established by the trust maker who designates a person or entity to manage the trust. The assets are held in that person’s (or entity’s) name until your passing, after which your assets will be distributed as per your wishes. Under a revocable trust, you can change its terms at any time and for any reason.

Determine your end-of-life wishes.

The first step in creating an after-life plan is to determine your end-of-life wishes. This includes decisions about medical treatment, funeral arrangements, and distribution of assets. Consider discussing your wishes with loved ones and documenting them in a legal document such as a will or advanced directive. It’s important to regularly review and update your wishes as your circumstances and preferences may change over time.

1. Create a will

Creating a will is the first step in creating an after-life plan. It ensures that your assets are distributed according to your wishes and that your loved ones are taken care of after you pass away.

2. Choose an executor

An executor is the person responsible for carrying out your wishes as outlined in your will. Choose someone you trust and who is capable of handling the responsibilities of being an executor.

3. Consider life insurance

Life insurance can provide financial support for your loved ones after you pass away. It can cover funeral expenses, outstanding debts, and provide ongoing financial support.

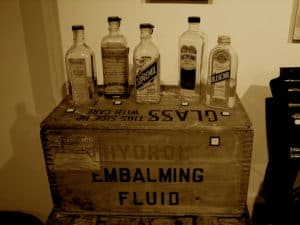

4. Plan your funeral

Planning your funeral in advance can alleviate the burden on your loved ones and ensure that your wishes are carried out. Consider whether you want to be buried or cremated, and what type of service you would like.

5. Organ donation

Consider donating your organs after you pass away. It can save lives and provide a meaningful legacy.

6. Digital assets

Consider what will happen to your digital assets after you pass away. This includes social media accounts, email accounts, and online banking. Make sure your loved ones have access to these accounts and know what your wishes are.

7. Communicate your wishes

Communicate your after-life plan with your loved ones. This can help avoid confusion and ensure that your wishes are carried out. It can also provide peace of mind for both you and your loved ones.

Get started with your After-life Plan

Hopefully these tips for an after-life plan inspired you to get started. If you need more help checkout our pre-planning guide https://www.cremation.green/plan/